kaufman county tax appraisal

Its county seat is Kaufman. For comparison the median home value in Kaufman County is.

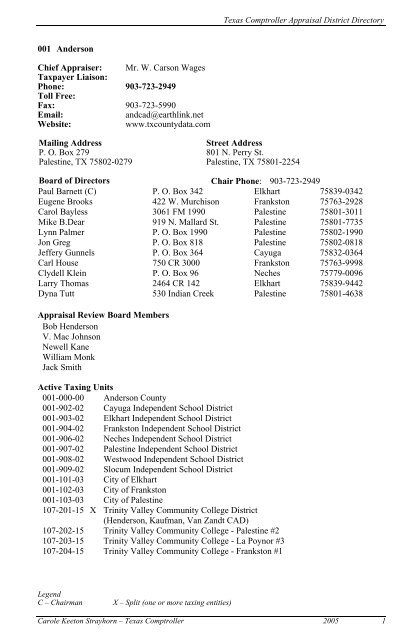

001 Anderson Chief Appraiser Texas Comptroller Of Public Accounts

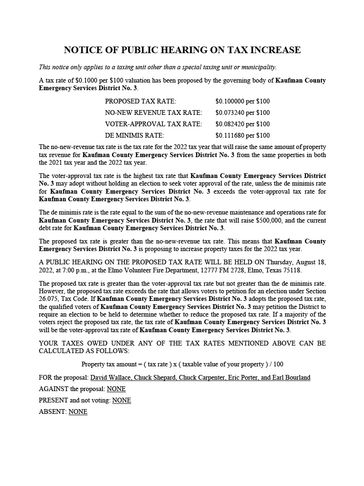

The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the.

. Information provided for research purposes only. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. As of the 2010 census its population was 103350.

The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code. The eligibility of the property for exemption. Contact your local County Appraisal District and they will be able to assist you with any exemption qualification questions.

Contact your local County Appraisal District and they will be able to assist you with any exemption qualification questions. Low Income Cap Rate 2015. Understanding the Property Tax Process.

The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. Each portfolio may consist of one or more properties and includes pertinent tax information such as property location certified owner and current year and total amounts due. VALUES DISPLAYED ARE 2022 CERTIFIED VALUES.

Kaufman Reappraisal Plan 15-16. Find foreclosures and properties with tax liens to get exclusive access to investment opportunities in the Kaufman area. TaxNetUSAs comprehensive database gives you full.

Henderson County Appraisal District. The fee will appear as a separate charge on your credit card bill to Certified Payments. Call 972-932-6081 or visit the Kaufman County Appraisal District website.

Both the county established in 1848 and. Find foreclosures and properties with tax liens to get exclusive access to investment opportunities in the Kaufman area. This indicates that residents in this county pay 188 in taxes for each 1000 of the value of their.

Property Tax System Basics. Call 903-675-9296 or visit the Southwest. Contact information for the following CAD Districts are as.

TaxNetUSAs comprehensive database gives you full. Contact information for the following County Appraisal Districts. The grant denial cancellation or other change in the status of an exemption or exemption application.

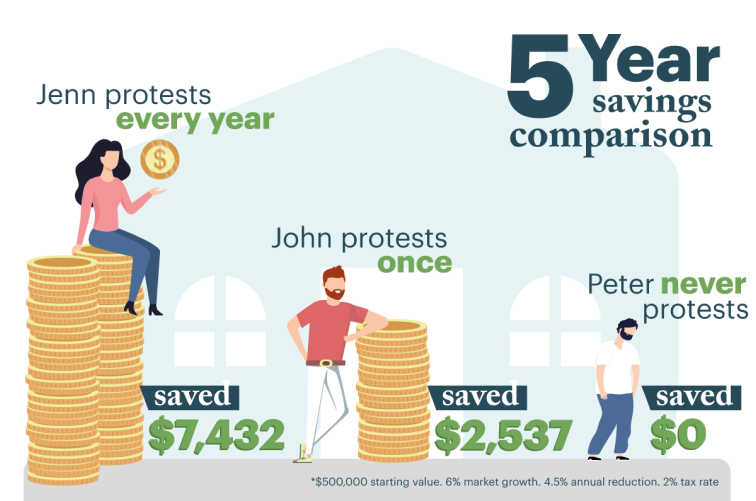

Kaufman County collects on average 2 of a propertys assessed. Legal descriptions and acreage amounts are for appraisal district use only and should be. You can search for any account whose property taxes are.

Contact Information 972 932-6081. Kaufman County Appraisal District. There is a fee of 150 for all eChecks.

Kaufman County is a county located in the US. Kaufman Central Appraisal District. Kaufman County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Kaufman County Texas.

Kaufman Cad Official Site Kaufman Tx

Attorney General Paxton Says In Person Property Appraisal Protests Must Be Available The Texan

Censored Property Taxes Texas Hunting Forum

Cr 151 Kaufman Tx 75142 Har Com

Amg Printing Mailing Tax Appraisal Supplies

Property Values Rising Again In Kaufman County Around Town Kaufmanherald Com

Kaufman County Delinquent Property Taxes Information Help Learn How To Apply For Kaufman County Property Tax Loans Tax Ease

Kaufman County Announces The Passing Of County Tax Assessor Brenda Samples Around Town Kaufmanherald Com

Cbs 48 Hours Coverage Of Kaufman County Da Murders Has Culturemap Ties Culturemap Dallas

Kaufman Cad Official Site Kaufman Tx

Censored Property Taxes Texas Hunting Forum